Growth & Marketing 101 for Startup Success

An appeal to founders, investors and marketing teams, because marketing is not magic, and abracadabra.

I like to think of startup marketing as a subset of Growth, where Growth is the holistic approach that startup teams employ to drive revenue generation, and to do it fast.

In the early stages, companies typically see founders with domain expertise and industry contacts drive growth through their own networks, referrals, and word-of-mouth. I call this founder-led growth.

How do you turn this into a repeatable scalable growth model?

Building your Growth Team

A growth team is usually cross-functional, with representation from sales, marketing, product, engineering, and customer success, all unified around a common objective - to acquire, activate, retain, and monetise customers (and drive word-of-mouth referrals). Ultimately, when done right, the team can generate revenue. This is in reference to the AARRR pirate metrics framework.

Startups may employ one or more “Growth Motions”, which represent distinct approaches that can be adopted to drive a growth strategy.

Marketing-Led Growth: In this motion, marketing efforts play a central role in acquiring and retaining users. This involves lead generation, demand generation, content marketing, and marketing campaigns that drive user acquisition and engagement.

Product-Led Growth: This approach focuses on building a product that's so user-friendly and valuable that it attracts and retains users without the need for extensive marketing or sales efforts. The product itself becomes the primary driver of growth.

Sales-Led Growth: Sales-led growth relies on the sales team to actively acquire and retain customers. It typically involves direct outreach, sales pitches, and relationship-building with potential buyers.

Here’s a table that summarizes the Growth Motions:

This is an appeal to founders, investors, and marketing teams, because marketing is not magic, and abracadabra.

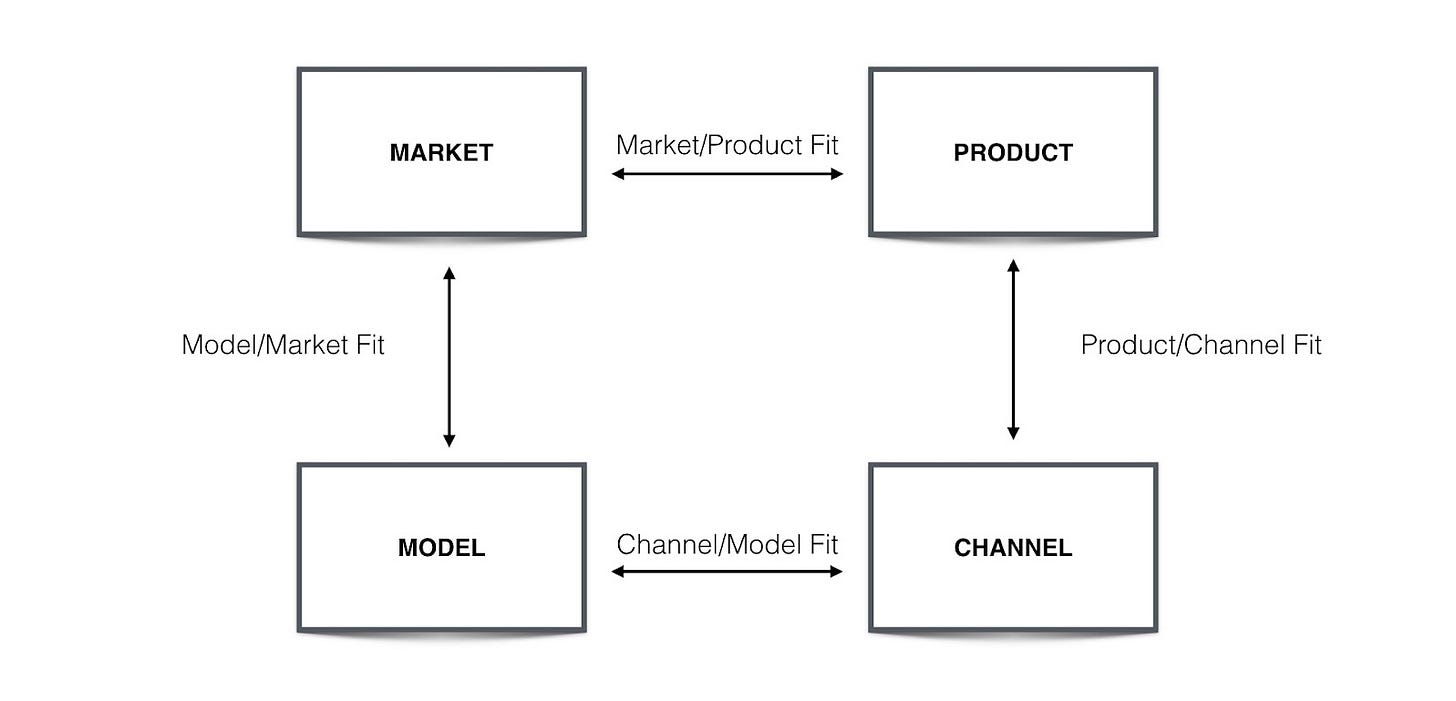

Largely inspired by Brian Balfour with some modifications, here are some key considerations for startups building their marketing strategy:

Prioritise Market-Product Fit

There’s a preference for “Market Product Fit” over the terminology “Product Market Fit” because you need to put your market first. While it might seem like a matter of syntax—potato, potato—how we phrase things can significantly impact our perspective.

Define your Market Hypotheses

Four key market elements to consider:

Category. What category of products does the customer put you in?

Who? Who is the target audience within the category? There are always multiple personas within a single category, so this breaks it down further.

Problems. What problems does your target audience have related to the category?

Motivations. What are the motivations behind those problems? Why are those problems important to your target audience?

For a company like Bujeti, the four elements will look like:

Category. financial management platform

Who? CFOs, financial managers, accountants, business owners, or finance teams within small, medium & large enterprises operating in Africa.

Problems. inefficient expense tracking, lack of centralized accounting, fragmented corporate banking, fragmented expense management tools, absence of real-time financial insights for effective decision-making.

Motivations. streamlined financial processes, compliance with financial regulations, improved expense control to enhance profitability, access to tailored corporate banking services, informed decision-making for business growth

Define your Product Hypotheses

Four key elements to consider:

Core Value Prop. What was the core value prop of the product? How did it tie to the core problem?

Hook. How could the core value prop be expressed in the simplest terms?

Time To Value. How quickly could we get the target audience to experience value.

Stickiness. How and why will customers stick around? What are the natural retention mechanisms of the product?

For a company like Bujeti, the hypothesis will look like:

Core Value Prop. Empowering African businesses with comprehensive financial management solutions.

Hook. Simplifying financial management for African businesses.

Time To Value. Rapid (within minutes). Upon signup and completion of KYB, users gain immediate access to centralized financial management tools.

Stickiness. Bujeti's stickiness is driven by its comprehensive suite of tools that become integral to daily financial operations, ultimately replacing the need for separate bank accounts and accounting tools.

In reality, market-product fit is an evolving target, achieved through continuous iteration. Startups begin by identifying a market, developing an initial product version, assessing its actual user value, and then refining both the market and product accordingly.

To determine whether you've achieved market-product fit, consider a combination of qualitative, quantitative, and intuitive indicators:

Qualitative indicators, such as Net Promoter Score (NPS), require minimal customer data and are relatively straightforward to assess.

Quantitative measures, such as retention curves and direct traffic, provide more in-depth insights into user engagement and product adoption.

Intuition, while difficult to articulate, plays a crucial role in understanding market-product fit. Gaining experience in situations with both successful and unsuccessful market-product fit can sharpen your intuition and guide your decision-making.

Be Mindful of your Channel

Great products cannot succeed without the right distribution channel. Channels have their ever-evolving rules that must be factored into a product’s lifecycle. For example,

Search engines: Search engines like Google determine what content appears in the top ten search results, control the appearance of those results, and decide which ads are displayed and the rules governing their cost.

Email clients: Email clients like Gmail define what constitutes spam, determine which emails land in the promo box, and regulate the acceptable content formats for emails.

LinkedIn: LinkedIn dictates the visibility of professional content, controls the display of posts in users' feeds based on algorithms, and regulates the reach of organic posts versus paid promotions.

TikTok: TikTok governs content visibility through its 'For You' page algorithm, determining which videos users see based on engagement, trends, and user preferences. It defines content formats that align with its short-form, engaging nature and sets standards for trends, challenges, and virality.

The list goes on and on.

Generally, here are some elements of products that fit with different categories of channels:

Paid Marketing. To have product channel fit with paid marketing:

Quick Time To Value - Users have less patience to find value when coming from an ad.

Medium to Broad Value Prop - Value prop needs to be fairly broad due to targeting constraints of ad channels.

Transactional Model - The product is built to extract transactional value to fund paid marketing.

Content Marketing

Broad Value Proposition: Content marketing aims to engage a diverse audience. A broad value proposition ensures content resonates with various segments, attracting and retaining users through valuable content.

Quick Time To Value: Engaging content should quickly showcase its worth, enticing users to explore further or take action.

UGC Capability: Content marketing often thrives on user-generated content. Products that enable and encourage users to create content increase engagement and foster community.

SEO

UGC Capability: SEO benefits from a wealth of unique, user-generated content. Products should facilitate content creation, enhancing SEO efforts by providing valuable and diverse content.

Motivation for Contribution: To sustain SEO success, products need to motivate users to contribute content consistently, ensuring a continuous stream of valuable information that improves search rankings.

ASO (App Store Optimization)

Quick Time To Value: Users browsing app stores need to quickly understand the app's value. ASO-optimized products must communicate their worth effectively and swiftly.

Broad Value Proposition: ASO relies on attracting a wide audience. The app's value proposition should appeal broadly to different users within the app store.

Virality. For virality to be a high-ceiling channel, a product at a minimum needs

Quick Time To Value. Virality thrives when the viral cycles are short.

Broad Value Prop. Value prop of the product needs to be applicable to large percentage of a user's network (branching factor).

Network Makes Product Better. Ideally, the product value increases the more of your network is on it.

Community

Network-Enhanced Value: Community-driven products often gain value as the user base grows. Encouraging users to invite others enhances the product's utility, making it more valuable as the network expands.

UGC Capability: Communities thrive on user-generated content. Products should empower users to create content, fostering engagement and community growth.

Motivation for Contribution: To sustain an active community, products need features that motivate users to contribute willingly, ensuring a continuous flow of diverse content and engagement.

Influencers

Network-Enhanced Value: Influencer marketing often leverages the influencer's network. Products that enhance value as the influencer's reach grows prove more beneficial.

Motivation for Contribution: Collaboration with influencers requires products that motivate them to authentically promote and engage with the product.

Public Relations

Broad Value Proposition: PR efforts benefit from products with a wide appeal that can resonate with different audiences.

Motivation for Contribution: PR often involves external contributions or mentions. Products should encourage and facilitate positive contributions and mentions from external sources.

Events

Quick Time To Value: Events need to immediately engage attendees, highlighting the product's value to ensure continued interest and participation.

Network-Enhanced Value: Events benefit from increased attendance and engagement as the network grows. Products should encourage and facilitate networking and expanded participation.

Partnerships

Network-Enhanced Value: Partnering with other entities amplifies the product's value. Products should facilitate collaboration and mutual benefit between partners.

Transactional Model: Partnerships often involve transactions or exchanges. Products should support these transactions efficiently.

Enterprise Sales

Quick Time To Value: Products involved in outbound / inbound sales need to swiftly demonstrate value to potential leads or prospects.

Transactional Model: Sales efforts require a product that smoothly transitions leads through the sales funnel towards transactions.

What is the Business Model?

The business model encapsulates two key components:

1. How You Charge:

This pertains to the pricing strategy or method used to generate revenue from your product or service. Common models include:

Free (Monetized with Ads): Offering the product for free to users while generating revenue through advertising.

Freemium: Providing a basic version for free and offering premium features at a cost.

Transactional: Charging users per transaction or usage, such as pay-per-use or pay-per-item.

Free Trial: Offering a limited period for users to experience the full product before requiring payment for continued access.

Subscription (One year up front, Monthly, Annual): Charging users on a recurring basis, either monthly, annually, or upfront for a specified duration.

2. Average Annual Revenue Per User (ARPU):

This metric indicates the average revenue earned from each customer or user per year.

It's calculated by dividing the total revenue generated by the number of users or customers over a specific period. For instance, if a company earned $100,000 from 1,000 users in a year, the ARPU would be $100.

There is a preference for ARPU because most startups need to keep their payback period to less than one year. If it is much longer than one year then you will need a lot more cash to fund growth.

Make sense of your Unit Economics

In business, there's a spectrum between how much you make from each customer (ARPU) and how much it costs to get those customers (CAC).

On the left, some businesses have lower earnings per customer and use low-cost ways to attract them. On the right, businesses with higher earnings can afford more expensive ways to get customers.

In the middle lies a tricky area—the ARPU-CAC Danger Zone. Companies here struggle because:

The Product is too pricey to be bought by clicking on an ad.

Some products are too expensive for simple ads or low-cost methods to attract buyers. If something costs a lot, people are less likely to buy it right away from an ad. The higher the cost, the harder it is to sell through these cheaper channels.The Product cannot pay for the cost of acquisition.

Other companies here can't afford the pricier ways to get customers because they don't make enough from each customer. Their earnings don't cover the cost of getting more customers.

Staying out of this tricky zone is crucial. Startups need to find a good balance between what they earn from each customer and what they spend to get them, ensuring their business model is sustainable in the long run.

Set Revenue Targets

To figure out a realistic revenue target, there’s a simple math:

ARPU x Total Customers In Market x % You Think You Can Capture >= $1M

If you intend to build a $1M business, take the average annual revenue per customer/user, multiply it by the total number of customers/users in your target market, and then multiply that by the percentage you think you can capture. That should equal or be greater than $1M.

For example, looking at the startup segment for Bujeti in Africa.

Total Customers In Market:

There are an estimated 3,800 startups in Africa.

ARPU (Average Revenue Per User):

The ARPU for Bujeti is calculated to be $250 annually per user.

% You Can Capture:

A realistic estimation might be capturing 10% of the market within the first few years

$250 x 3,800 x 10% = $95,000

The calculation shows that the estimated revenue, based on capturing 10% of the estimated 3,800 startups in Africa at an ARPU of $250, amounts to $95,000.

This analysis suggests that with the given parameters, focusing solely on the startup segment in Africa might not suffice to reach the $1M revenue target. Further adjustments in either the ARPU, market size estimation, or capture rate might be necessary to meet the desired revenue goal.

This is part of a four-part series that started with this article on Navigating the Startup Landscape in Africa.

In my next article, I talk about how to foster sustainable growth beyond financial backing. Stay updated on my Substack publication.